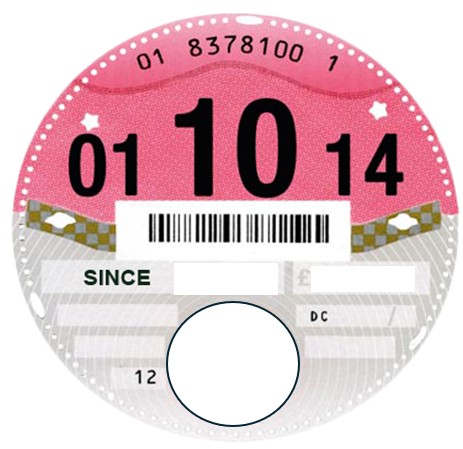

This innocuous paper circle was the downfall of many in SE London during the early ’80s but sadly(?) ceased to be utilised some 10 years ago.

Not displayed, a note stating ‘in post’ affixed, swapped between vehicles to fool a casual observer, altered, even forged, meant the tax status, vehicle and occupants were worthy of further attention.

The upper pockets of a police tunic could house a book of ‘producers’ (immortalised by Smiley Culture) alongside a whistle attached by silver chain from a central uniform. The mirror image pocket, could contain a like-sized book of CLE/6 forms used to notify the DVLA of an untaxed vehicle on a road. Either pocket still had room for the standard issue note book (Waterlow Publishers ltd).

Years ago, it was possible, by 4am of a night shift, even SE London streets had quietened. Contrary to the understanding of some, few, if any, officers would wander the streets spinning their truncheon officer Charlie-Dibble-like (Top Cat), whiling away the hours.

For some, it would now be VERA time. Not the ‘there’ll be blue birds over …’ Vera, but the Vehicle Excise and Registration Act 1994. But then, in the 1980’s ‘no tax’ fell to the Vehicles (Excise) Act 1971 (Repealed 01/09/1994)

No need for stealth or subtlety, an officer could move between parked cars to ensure, nestled in the lower nearside corner of a vehicle windscreen, was a colourful (correct hue for the year) disc. Checking the Vehicle Registration Mark (VRM), expiry date, cost and likely the issuing post office stamp. Absence of the disc and a CLE2/6 would be submitted without the vehicle keeper’s knowledge. A few weeks later, the keeper would receive a surprise.

Submission of a handful of CLE2/6’s, at the very least, evidenced some officer-activity in the wee hours. But it would often identify vehicles warranting further attention. An extreme event; an altered disc noted, the car was returned to in daylight. Approaching the vehicle, the about to be driver produced a firearm and was arrested … well … shortly after ‘falling over’ a police car. Another story.

Then, as now, the DVLA’s primary role appears to be about tax (VEL) collection.

It was (2018) suspected that 2% of vehicles are incorrectly taxed – 1 in 50 committing a criminal offence*.

However, according to the Department for Transport’s 2023 data, approximately 498,000 vehicles in the UK were unlicensed, representing 1.2% of all registered vehicles (34 million?) – as opposed to those on a road. Fleet World reported ‘That’s down from the 1.9% non-compliance level in 2021 but significantly higher than the 0.6% figure recorded in 2013 prior to the abolition of tax paper discs in October 2014‘.

Hmmm … 498,000 is over 1.4% of 34million. However, 0.6% of 34 million is about 200,000 and 1.2% is twice this. It therefore appears, using this ‘back of a fag packet’ calculation, following the demise of the tax disc, about 200,000 more vehicles are untaxed – this despite an increase in vehicle ‘surveillance’. Possibly the financial admin’ saving is outweighed by loss of revenue … and a system that appears to encourage or enable greater avoidance?

04/2025

*In the United Kingdom, operating or keeping an unlicensed vehicle on public roads is a criminal offence under the Vehicle Excise and Registration Act 1994. Section 29 of this Act states that individuals found using or keeping an unlicensed vehicle are guilty of an offence. Read more here.